Our Technology

AI and Neuro-Fuzzy Systems

At Sunrise Trading System, we rely on state-of-the-art AI and Neuro-Fuzzy technologies to predict market changes with exceptional accuracy. Our technology combines the power of neural networks with the flexibility of fuzzy logic. This enables us to process complex, non-linear market data and make informed trading decisions. In addition to mathematical models, practice-oriented modules ensure the required stability and flexibility that has proven effective over the years. A reliable system – continuously improved and adaptable to new conditions.

Neural Networks

Deep learning models that can identify complex patterns in market data

Fuzzy Logic

Handles uncertainty and imprecision in financial data

Data Analytics

Advanced statistical analysis of historical and real-time market data

Predictive Modeling

Forecasting market trends and asset prices

Our Process

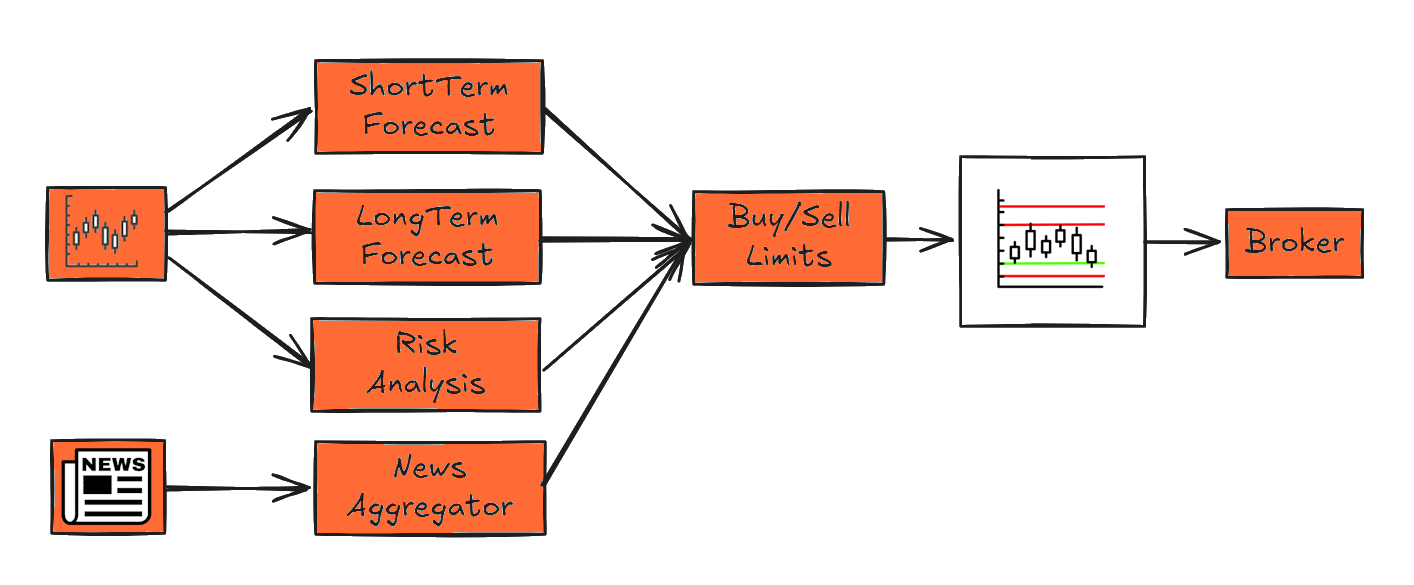

Our AI-driven trading system follows a sophisticated process to generate precise predictions. These are translated into a robust and successful strategy using limit orders and stop-loss thresholds. The system is independent of computing power, connectivity, and transmission performance. Its simplicity and offline-ready output enable full traceability and control – even without real-time pressure:

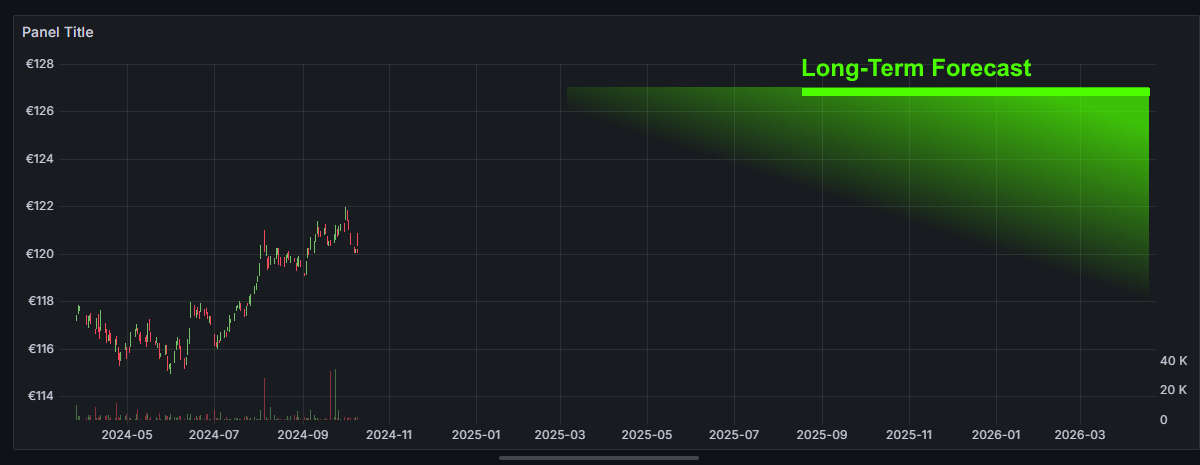

📅 Long-Term Forecast

The long-term forecast evaluates how a company or asset is expected to position itself in the market over time. Global and local economic or political changes are considered. A trend and projection are derived based on long-term market development.

📈 Short-Term Forecast

The short-term forecast identifies a trend based on historical training data and aggregated news. It has a strong influence on the defined trade limits. However, it requires correlation with other values to support a concrete buy decision, as its timeframe is limited.

📰 News Aggregation

A large language model (LLM) is used to process news content by analyzing the text for trends that can be predicted or derived. The LLM evaluates each trend along with its confidence level and provides a structured output to downstream processes. It is important to note that the LLM itself does not need to understand actual stock prices.

At regular intervals, various news sources are queried. An AI model analyzes the retrieved news and categorizes key performance indicators (KPIs) based on individual news items.

The following dimensions are evaluated:

- Relevance and dependency on a specific stock or multiple securities.

- Expected trend derived from the news content.

- Classification of the impact as short-term or long-term.

- Assessment of the significance and reliability of the forecast.

- Possible dependency or inverse correlation with other securities.

All current news items are aggregated using a defined key. The resulting KPIs are then further processed and visualized.

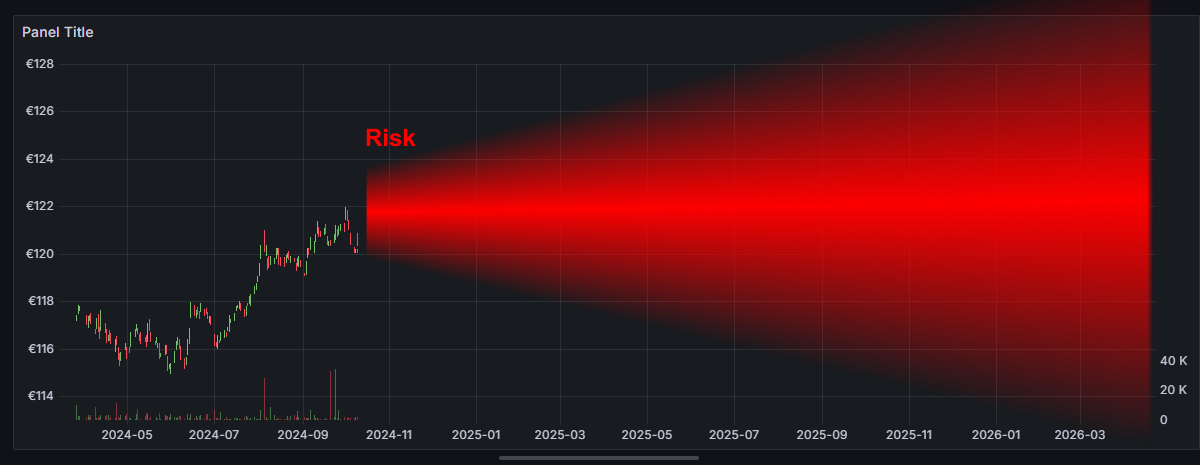

⚠️ Risk

SunriseTradingSystems continuously monitors both short-term and long-term risks. Long-term risks are assessed using market news and other data sources. A high volume of news, or strongly contradictory signals, leads to a higher risk score. Trading volume and volatility are also factored into risk classification. A high risk value indicates stronger potential price fluctuations – not necessarily negative outcomes. Low risk means stable price movement is more likely. An influx of critical short-term news may signal the need for fast action. After a purchase, the risk profile is used to define sell limits. Over time, the risk window expands relative to the purchase date. Limits can then be dynamically adjusted for existing portfolios.

🔒 Robustness

All systems are subject to errors – in input data, processing, or decision logic. Failures and unforeseen events may occur. Forecasts are always based on historical data, and conditions can change. The system therefore defines sell and buy limits that can be executed directly at the exchange. This enables time and system-level decoupling. Robustness is enhanced by aggregating various data sources – not just technical indicators. Market and news-based signals, as well as correlations or counter-correlations to related assets, are factored in. A predefined pool of assets is considered, not the entire market. This focus ensures clean segmentation and reliable execution.

🔮 Forecast

The forecast module calculates expected short-term and long-term trends based on historical data and news. The forecast itself is the expected price at a specific point in the future. Short- and long-term forecasts may contradict each other. Such contradictions result in a weak buy signal. To avoid increasing the risk of an existing position, a new forecast does not change limits already defined at the time of purchase.

💵 Buying

Based on trends, forecasts, and analyzed news, two buy limits and the intended volume are set. Assets are not independent – they behave in correlated ways. Therefore, related assets are included in the recommendation. The decision also considers current holdings and portfolio diversification. By using limits, purchases are time-decoupled and can benefit from intraday market effects.

🏷️ Selling

Only through a sale does an investment become a realized value. SunriseTradingSystems sets multiple parallel sell limits.

- Profit-taking: A sell limit is placed above the purchase level based on forecasted gains. This order is placed immediately upon purchase. Depending on risk and opportunity, only part of the position may be sold. A second, higher limit can be defined for the remaining shares.

- Loss protection: Markets may deviate from predictions. Situations and news may shift. A first stop-loss limit is placed below the entry price to reduce exposure during negative trends. A second, deeper limit is used to protect against total losses. If the price drops sharply, the asset is removed from the portfolio automatically.

📊 Decision Making

After a purchase, the sell limits are determined. In some cases – especially with both short- and long-term upward trends and high risk – a strategy may involve using the stop-loss level as a re-buy signal. This increases exposure, but also the chance of profiting from the anticipated trend. For volatile assets, this can be an effective strategy. With every additional buy, future sell limits are recalculated.

Decision Logic

Decisions are made based on a combination of signals. A filter ensures that fewer trades are executed within a short timeframe. The approach is conservative – avoiding short-term speculation. Instead, the system targets broader market movements or leverage effects. Decisions are submitted as limit orders, not direct trades.

💼 Model Portfolio

We operate multiple model portfolios that reflect the overall strategy of SunriseTradingSystems. The level of investment varies across portfolios. All portfolios are displayed with a time delay and do not use live market prices. This separation allows for:

- Transparent performance comparison

- Controlled model testing

- System reliability during outages and maintenance

Each client also receives a dedicated portfolio, ensuring a clear separation between accounts and enabling trades to be aligned with individual preferences. Every client can define the markets or stocks that are of personal interest and should be included for trading.

In addition to equities, the system also supports trading of:

- Certificates

- ETFs

- Bonds

Money Management

The diversification of a portfolio and the risk appetite are individual decisions. Therefore, SunriseTradingSystems initially provides only buy or sell recommendations. Depending on the opportunity–risk ratio, the system suggests appropriate position sizes.

At the same time, it ensures that sufficient liquid funds remain available, allowing the investor to take advantage of new opportunities quickly when they arise.

🧩 Training and Testing

For the development and robustness of the trading system, a well-designed data strategy is essential. It is crucial to define which market segments the models are optimized for and which data are used to validate whether the strategy remains stable under different market conditions.

The automated trading logic is developed based on historical data. Development, testing, and optimization are performed using carefully selected historical datasets, taking into account different market phases (upward, downward, and sideways trends) and multiple time periods. Typically, around 75% of the available data is used for training.

Before a model is put into practical use, the validation phase is carried out using the remaining 25% of the data — without any further adjustment of the strategy. Evaluating the final automated trading strategy shows how robust or over-optimized the model is.

Important: Training and test datasets must not overlap in time, as this could lead to overfitting. The principle of separating training and testing data follows the same logic as in AI model development, where a clear split between training and validation datasets is always maintained.

🖥️ Offline Model Training

Our system utilizes an offline model to train and verify predictions using historical trading data. This approach allows us to:

- Continuously improve our prediction accuracy without impacting real-time operations

- Test new strategies and algorithms in a controlled environment

- Validate model performance against a wide range of market conditions

- Ensure robustness and reliability before deploying updates to our live trading system

Trading prediction

Different modules are working together to generate simple and robust trading signals.